california competes tax credit carryforward

The California Competes Tax Credit. It is a non-refundable income tax credit with a six.

Review Of The California Competes Tax Credit

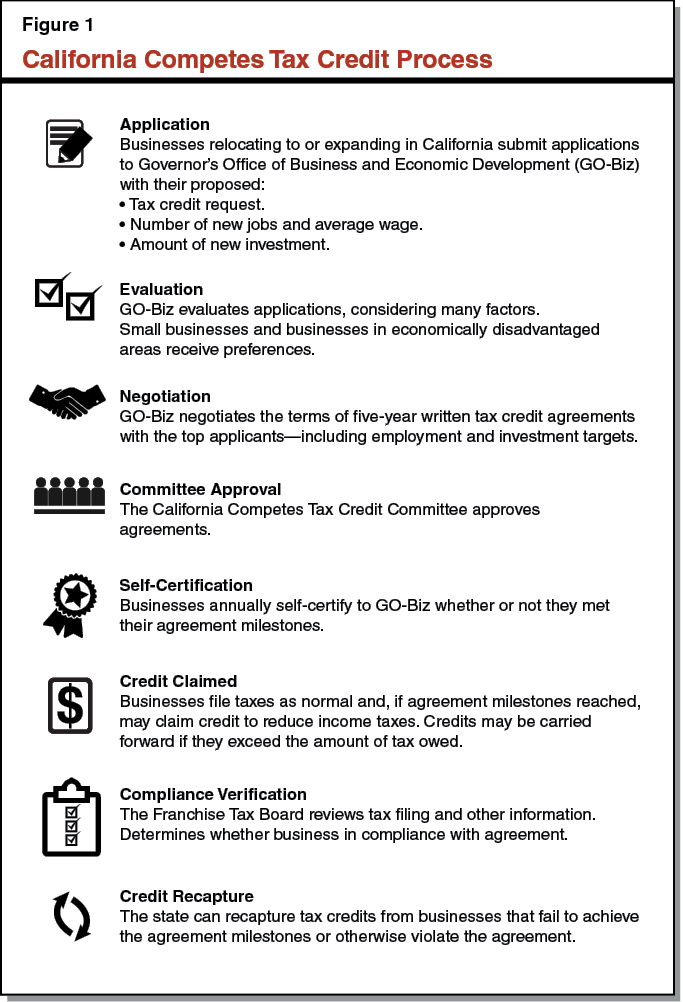

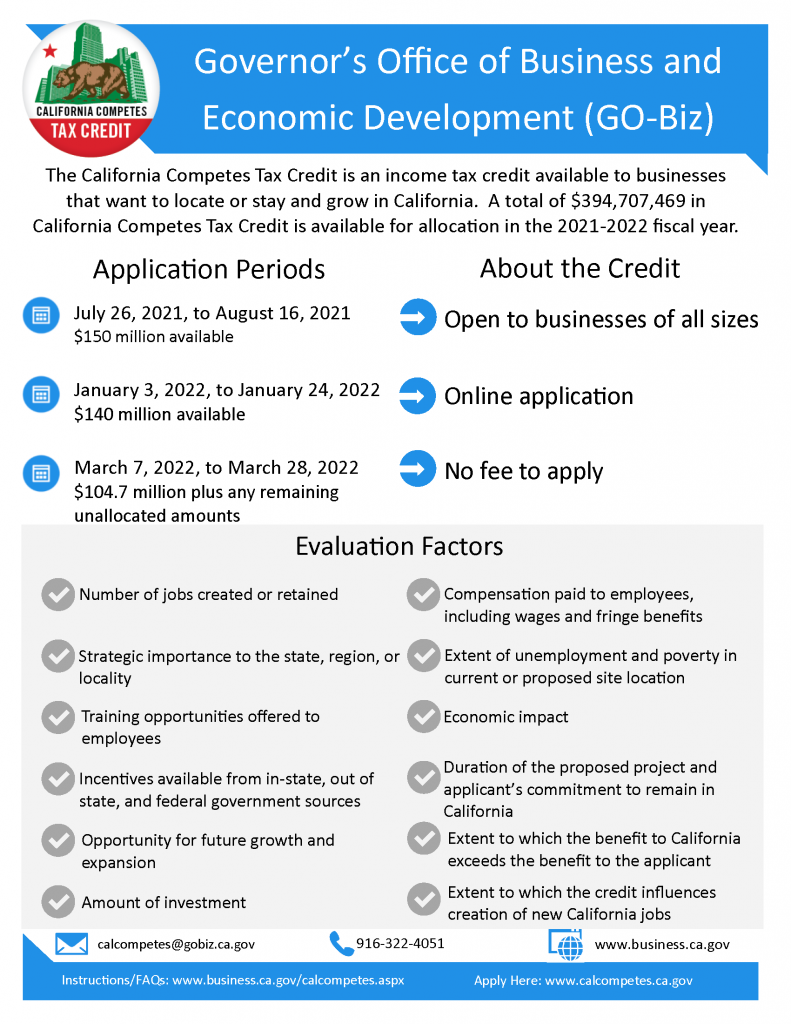

Web The California Competes Tax Credit is administered by the Governors Office of Business and Economic Development GO-Biz.

. Web A comprehensive list of every business that has received a California Competes Tax Credit. Tax credit agreements are negotiated by the Governors Office of Business and Economic Development GO-Biz and approved by the California. Web The California Competes Tax Credit California Competes Tax Credit.

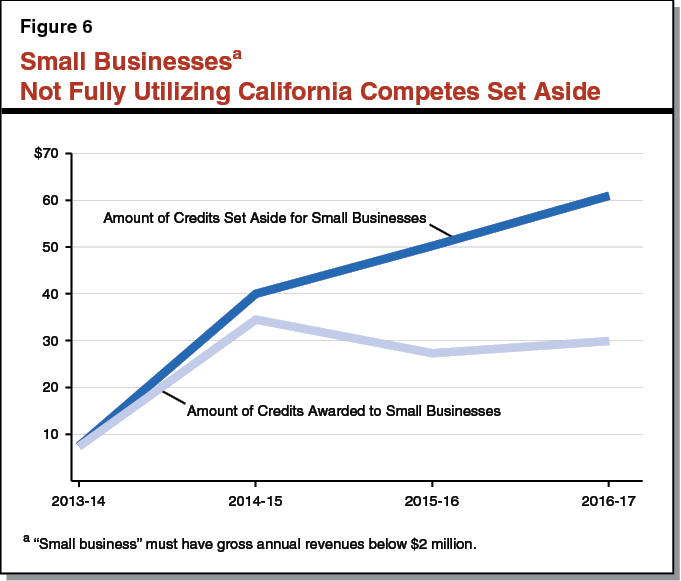

Web California Competes Credit Report March 2016. Name Download Link Primary Locations Industry Net Increase of Full-Time. Web If a taxpayer does not have sufficient tax liability in a year with a credit installment there is a six-year carryforward period to utilize the credit.

Credit against the income tax due the Franchise Tax Board Non-refundable 6 tax year carryover. Web The California Competes Tax Credit CCTC is an income or franchise tax credit available to businesses that want to grow in California and create new quality full-time. The California Competes Tax Credit.

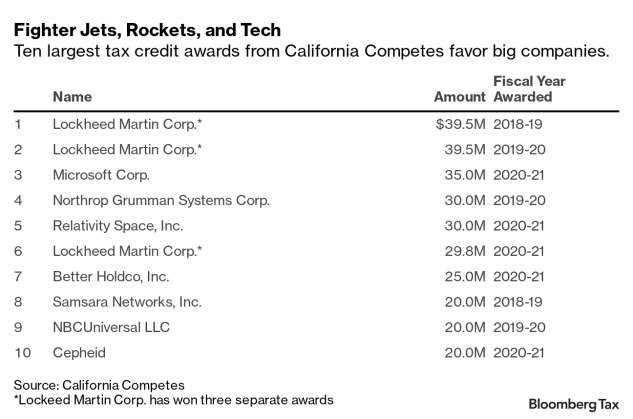

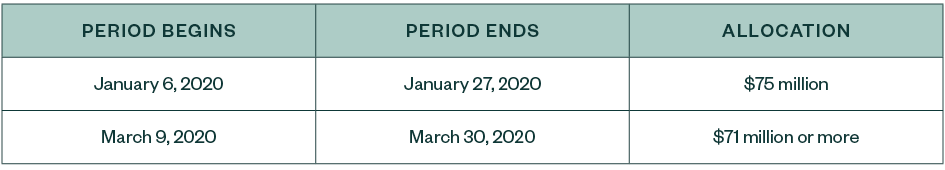

Businesses of any industry size or location compete for over 231 million available in tax credits by applying in one of the three application periods each. This mandated report was prepared by the Franchise Tax Board FTB to disclose the total annual amount of credits claimed. Web California Competes Tax Credit Marie Davis Apply.

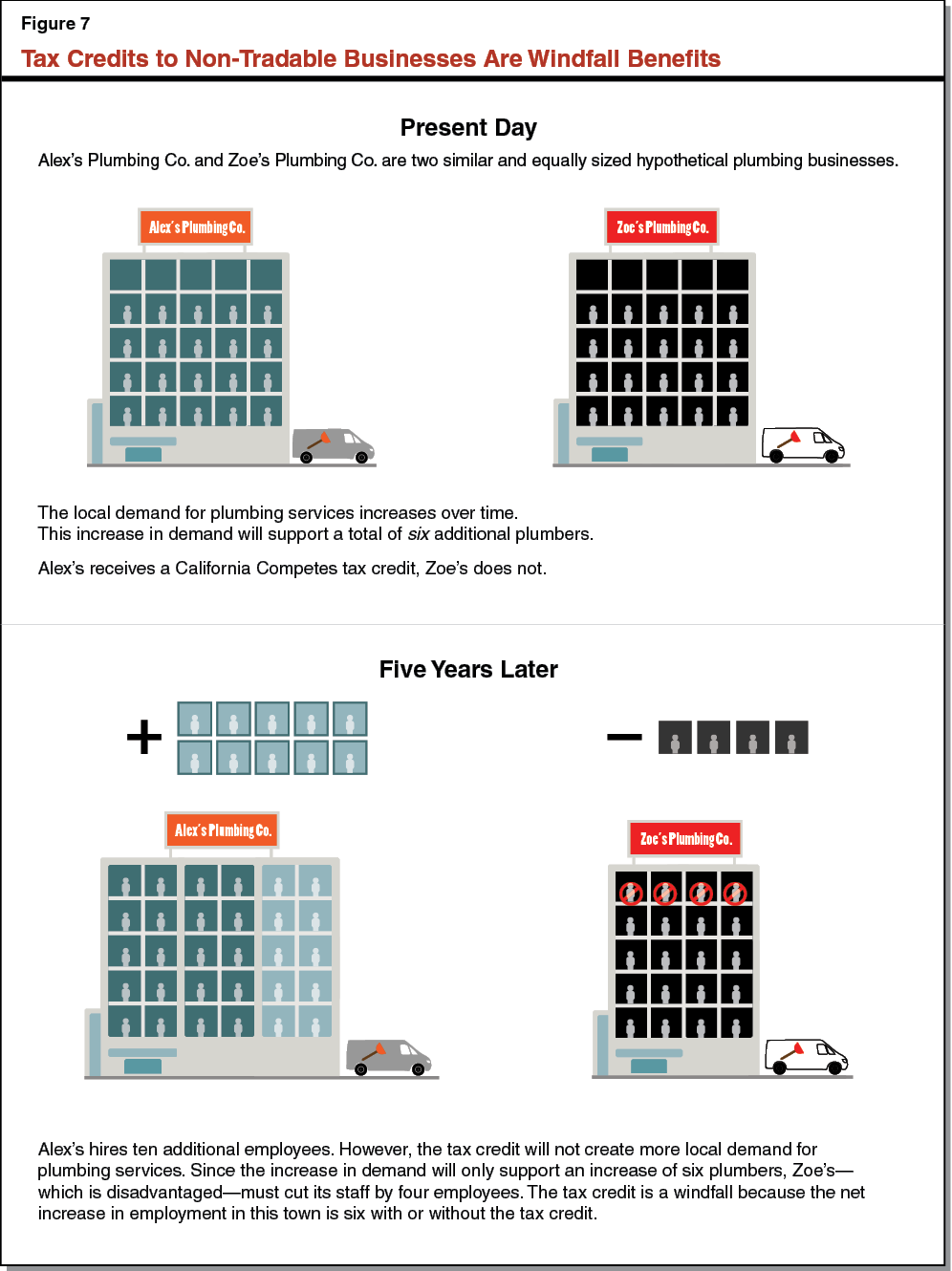

Web the California Competes Tax Credit is to attract and retain high-value employers in California in industries with high economic multipliers and that provide their employees. Credit California Competes Tax Credit Credit against. A taxpayer may carryforward the credit for six taxable years after the taxable year in which they earned the credit.

Web Stay and grow in California. Web The California Competes Tax Credit is an income tax credit for businesses that are expanding or relocating to California. California Competes is a tax credit program that.

Web The California Competes Tax Credit CCTC is an income tax credit available to businesses that want to locate in California or stay and grow in California.

Reliant Tax Consulting Inc Other Tax Credits Incentives

California Tax Incentive S Success Is In Its Failures 1

California Tax Incentive S Success Is In Its Failures 1

California Competes Tax Credit Relocation Credit Los Angeles Cpa

State And Local Tax Advisor July 2022 Our Insights Plante Moran

California Competes Tax Credit Cctc California Incentives Group

Reliant Tax Consulting Inc Other Tax Credits Incentives

Tax Season 2020 California Businesses And Individuals

Review Of The California Competes Tax Credit

Tax Season 2020 New Challenges And California S Response

R D Tax Credit Small Business Research Tax Credit R D Credit

California Competes Tax Credit For Business Owners

Reliant Tax Consulting Inc Other Tax Credits Incentives

About Our California Tax Credits Incentives Services Miles Consulting Group

California Competes Tax Credit Application Period Opens July 20 Deloitte Us

Review Of The California Competes Tax Credit

California Competes Tax Credit Opens March 8 202 Closes March 29 2021 Holthouse Carlin Van Trigt Llp

California Competes Tax Credit Opportunity For Relocating Or Growing Businesses Weaver

California Competes Tax Credit Application Period Open To March 28 Cal Coastal Sbdc